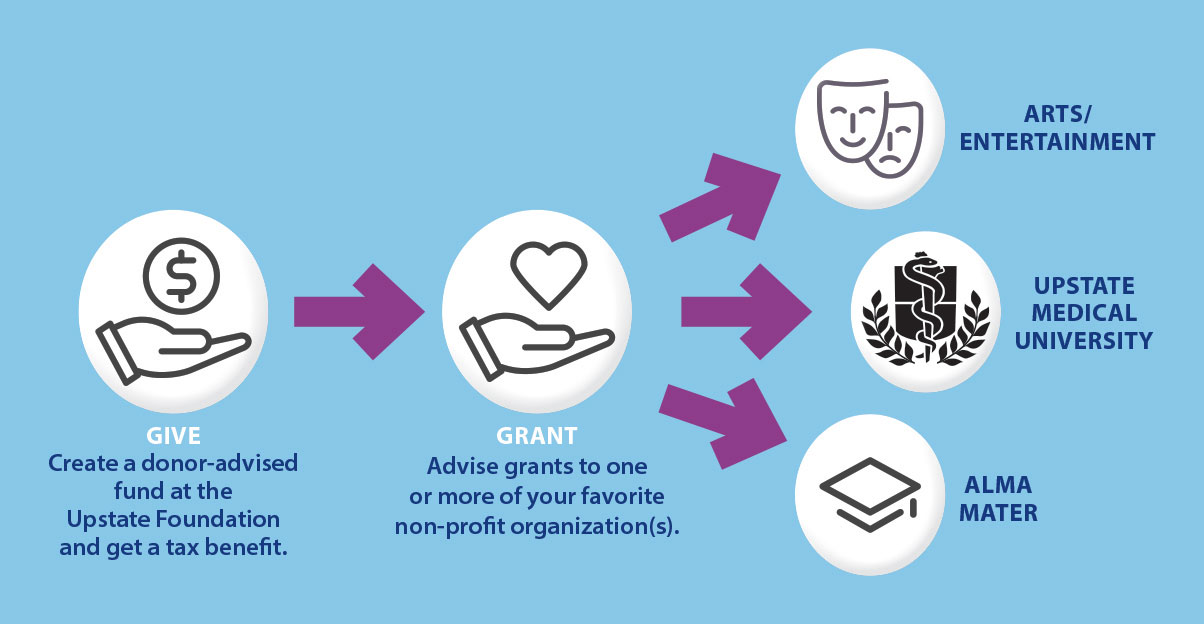

How our donor-advised funds work

A donor-advised fund can be established by an individual or company at the Foundation in order to disburse charitable gifts to qualified not-for-profit organizations. This includes, of course, Upstate Medical University as well as local and national nonprofits that are meaningful to you. Simplify your giving and enjoy the tax advantages of a donor-advised fund.Donor-advised funds can be established for a minimum of $5,000 or $10,000.

-

$5,000 – A donor-advised fund established for $5,000 functions similarly to the Foundation’s restricted funds in that the principal is guaranteed, not invested, and an administrative fee is not charged.

-

$10,000 – A donor-advised fund established for a minimum of $10,000 can be likened to an investment account dedicated solely to a donor’s charitable giving. The principal is invested through the Foundation, generating investment returns. Both the principal and investment returns are available for spending based on the donor’s areas of interest. Although this type of donor-advised fund is not a lifelong fund like an endowment, a donor may appoint a successor to continue his or her legacy of giving.

In either case, you “advise” the Foundation on how your charitable dollars are to be spent – and we’ll do all the rest, including making sure your giving goals are met, setting the fund up, establishing contact with your preferred charities, and reporting back to you on annual basis (including documentation you can use for tax purposes).

Helpful links

- Information sheet to review and/or download to share with your financial advisor – click here

- Donor-Advised agreement form to complete the application process – click here

- Instructions on how to make a contribution – click here

- Distribution requests, for existing DAF advisors, to qualified charitable organizations from your fund – click here

Learn more or get started in setting up your donor-advised fund!

If you have any questions on setting up a donor-advised fund for a convenient and expertly managed fund for all of your charitable gifts, contact the Upstate Foundation at 315-464-4416, or use contact form below and someone will reach out to you.